The tax on sugary drinks in Catalonia has lowered their consumption

An article by Judit Vall Castelló (IEB-UB and CRES-UPF) and Guillem López Casasnovas (CRES-UPF) analyses the effects of the tax on sugary beverages on their sales and consumption in Catalonia. The results show a 22% reduction in their consumption compared to before the introduction of the tax, meaning an intake of 107 calories less per person per week among consumers

Overweight and obesity are a major health problem in the world: in 2015, 54% of the adult population in OECD countries was overweight, and about 19.5% of the population was obese. The consumption of sugar is considered one of the main causes of the increase in the rates of overweight and obesity, which affect the child population significantly.

In this context, in 2016 the World Health Organization (WHO) issued a report with a number of recommendations for the governments of developed countries, such as the introduction of taxes for a group of products considered harmful (which would involve a price increase of at least 20% to be effective), with the aim of reducing their consumption and improving the health of the population.

In this context, in 2016 the World Health Organization (WHO) issued a report with a number of recommendations for the governments of developed countries, such as the introduction of taxes for a group of products considered harmful (which would involve a price increase of at least 20% to be effective), with the aim of reducing their consumption and improving the health of the population.

Following the WHO recommendation, the Government of the Generalitat of Catalonia implemented a tax on sugary beverages on the sales and consumption of these drinks in Catalonia, which came into force on 1 May 2017. The tax (the amount depends on the grams of sugar included) falls on all beverages that have added caloric sweeteners, and the legislation establishes for the first time the requirement that 100% of this tax must be added to the final price of the product.

Judit Vall Castelló, a researcher at the Barcelona Institute of Economics (IEB) of the University of Barcelona and the Centre for Research in Economics and Health (CRES) at UPF, and Guillem López Casasnovas, director of the CRES-UPF and professor of the University’s Department of Economics and Business, are the authors of the study. It is a pioneer work in assessing the effects of the tax on sugary drinks on their sales and consumption in Catalonia, which shows a direct relationship between increased prices and reduced intake.

“These results are important, since there are many countries that are about to introduce a similar tax, like the United Kingdom, Ireland or South Africa, for example. These countries will propose the introduction of taxes on sugary drinks this year, and our study may help policy-makers to take decisions”, suggest the authors, who believe that the application of the tax may lead to improvements in health outcomes in the medium and long term.

Lower consumption of sugary drinks

The study, “Impact of the tax on sugary beverages on the consumption of these drinks in Catalonia” uses data from a supermarket chain that has a 10% market share in Catalonia, with about 160 shops, and is present throughout Catalan territory. The data come from the weekly sales of 105 selected products that the authors separate into three groups: sugary drinks (subject to tax), zero- and light-type drinks, and water, the latter two groups not subject to the tax.

The study, “Impact of the tax on sugary beverages on the consumption of these drinks in Catalonia” uses data from a supermarket chain that has a 10% market share in Catalonia, with about 160 shops, and is present throughout Catalan territory. The data come from the weekly sales of 105 selected products that the authors separate into three groups: sugary drinks (subject to tax), zero- and light-type drinks, and water, the latter two groups not subject to the tax.

The results show that the tax causes a fall in the consumption of sugary drinks by six litres per week, product and store with respect to consumption of light/zero beverages. These figures represent a reduction of 22% compared with consumption prior to the application of the tax.

Also part of the fall in the consumption of sugary drinks is replaced by the consumption of light and zero drinks (the so-called “substitution effect”), which have increased their sales since the enforcement of the tax.

These results are due, in part, to the fact that the price increase exceeds 20% for drinks in large-format containers, following the recommendations of the WHO to ensure a significant reduction in consumption and the effectiveness of the tax.

Reduction of calories ingested and different results depending on the area of Catalonia

The authors extrapolate their results to all Catalan consumers of such beverages, concluding that the tax leads to a reduction of 107 calories per person per week. To make this calculation they used data from the Catalan Health Survey on the percentage of Catalans who consume sugary drinks (of the population of about 5.5 million in Catalonia between 20 and 80 years of age, 22% drank this type of drinks daily).

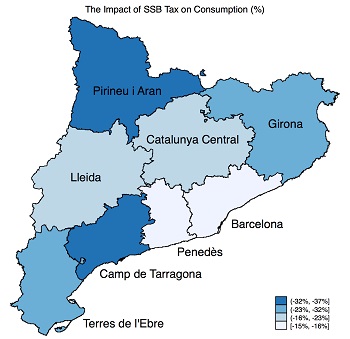

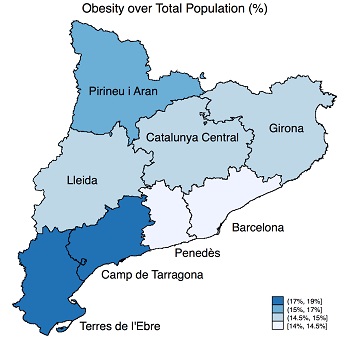

One of the sections of the study shows the different impact of the tax according to the areas of Catalonia and which types of consumers are most sensitive: so, the effects are greater in non-tourist areas and in areas with a higher rate of obesity (measured using data from the Catalan Health Survey, ESCA 2016), while the effects are similar in areas with higher family incomes and lower family incomes.

In order for all of this to be effective, Judit Vall Castelló and Guillem López Casasnovas stress the fundamental requirement that the tax on sugary drinks must fulfil: “The results of our study are conditioned to the fact that the tax is added to the final price, as the law stipulates, and therefore, it is very important that the authorities should create the mechanisms to enforce this point, such as fines or penalties, for example”.

Reference article: Judit Vall, Guillem López Casasnovas (abril 2018). "Impact of SSB taxes on consumption"